Climate Governance

The Company has formulated a governance mechanism for risks and opportunities related to climate change in accordance with the Guidelines on Climate-related Financial Disclosures of Insurance Companies promulgated by the competent authority. The Board of Directors bears the ultimate responsibility for managing climate-related risks. The Company has included the management status of climate-related risks in its Risk Integration Report, which is submitted to the Board of Directors.

Furthermore, the Company has established a Risk Committee under the Board of Directors. The committee is in charge of reviewing, establishing, and approving matters related to risk management. Matters related to the climate-related risk appetite need to be submitted to the Risk Committee and then the Board of Directors for review. In addition, the risk management unit regularly reports climate risk-related issues to the Board of Directors. Issues are all reported in senior management meetings prior to being reported to the Board. The Company's climate governance is implemented through a three-tier management structure consisting of the Board of Directors, the Risk Committee, and the senior management meeting, as well as the three lines of defense of climate governance.

Climate Strategy

● Risk Monitoring and Response Strategies

| Business category | Business management category | Possible climate risk factors | Risk response measures |

|---|---|---|---|

| Investments | Corporate bonds and equity investments for non-trading purposes (all industries) | Transition risk factors -Policy and legal (carbon costs) -Technology transformation -Market preferences |

Sustainable investment policy regulations and methods are used to specify prohibited targets on the exclusion list and ESG-sensitive industries that should be strictly evaluated. When determining investment and financing asset allocations, the Company is required to take ESG risks into consideration in order to reduce fluctuations in profit from the overall investment portfolio, which also reduces relevant investment risks. |

| Income-generating real estate investments | Physical risk factors -Natural disasters including heavy rain and flooding |

Management regulations related to real estate investment are in place. When acquiring real estate, all risk factors that may affect the transaction price are fully evaluated. For new real estate investment projects, the four major aspects of the ESG checklist (energy, water, waste, and stakeholder engagement) are also used to evaluate a project’s positive and negative impacts on local communities and the environment, in order to achieve the sustainable goal of coexisting with local communities and the environment. | |

| Financing | Personal mortgages, real estate-secured corporate loans | Physical risk factors -Natural disasters including heavy rainfall and flooding |

Comprehensive credit-related measures, such as collateral review and valuation/appraisal management, have been formulated. The Company is required to determine whether real estate collateral is located in an area with frequent severe flooding, and to take this into consideration during the review and evaluation process. This is also considered when deciding whether to approve the loan itself or the loan amount requested. |

| Business operations | Business locations | Physical risk factors -Natural disasters including heavy rainfall and flooding -Drought |

A business continuity plan has been established, and disaster prevention and remote backup drills are regularly organized to respond to sudden natural disasters. Relevant units refer to the Template for Disaster Emergency Response Manual for Financial Institutions formulated by the competent authority and relevant actual operating scenarios to formulate an Emergency Response Plan. Prior training and simulation drills help prepare us to respond to and reduce the impact of natural disasters that may occur due to climate change (e.g., flooding and windstorms) on Company operations. |

| Climate opportunity item | Climate response strategy |

|---|---|

| Increased demand for climate-related insurance | Issue green insurance and typhoon and flood insurance products |

| Expansion of sustainable investment market | Invest in ESG-related funds and ETFs |

| Rising capital demand in low-carbon industries | Invest in bonds of low-carbon industry targets |

| Continue to invest in renewable energy public infrastructure investment projects |

The responses and actions above can reduce the transition risks we are faced with (e.g., policy and legal, carbon costs, technology transformation, and market preferences) and prevent the Company's investees from being affected, which could result in inferior financial and operational performance. It also enables us to better understand the ESG risks of investments by engaging with investees.

Nevertheless, sustainability-related knowledge is technical in nature, and we may not be able to determine whether the situation described by the investees during the engagement process is “greenwashing.” In addition, while developing products or targets that meet ESG and sustainability themes in the life insurance industry, the sales of such products or targets may see poor sales because of underdeveloped market understanding of the concepts involved.

Climate Risk Management

In 2020, Taiwan Life’s Board of Directors approved the Sustainable Insurance Policy, which stipulates that insurance operations should take into account ESG-related issues, including climate risks and opportunities. In 2021, in accordance with Risk Management Best Practice Principles for the Insurance Industry and CTBC Holding's Risk Governance Policy, we integrated climate change risk management principles into Taiwan Life’s Risk Management Core Strategy, Financial Transaction Credit Risk Management Policy, Operational Risk Management Policy, and Loan Credit Risk Management Policy as the framework for the overall business risk management of the Company and its subsidiaries, as well as amended the Responsible Investment Policy and Responsible Investment Regulations.

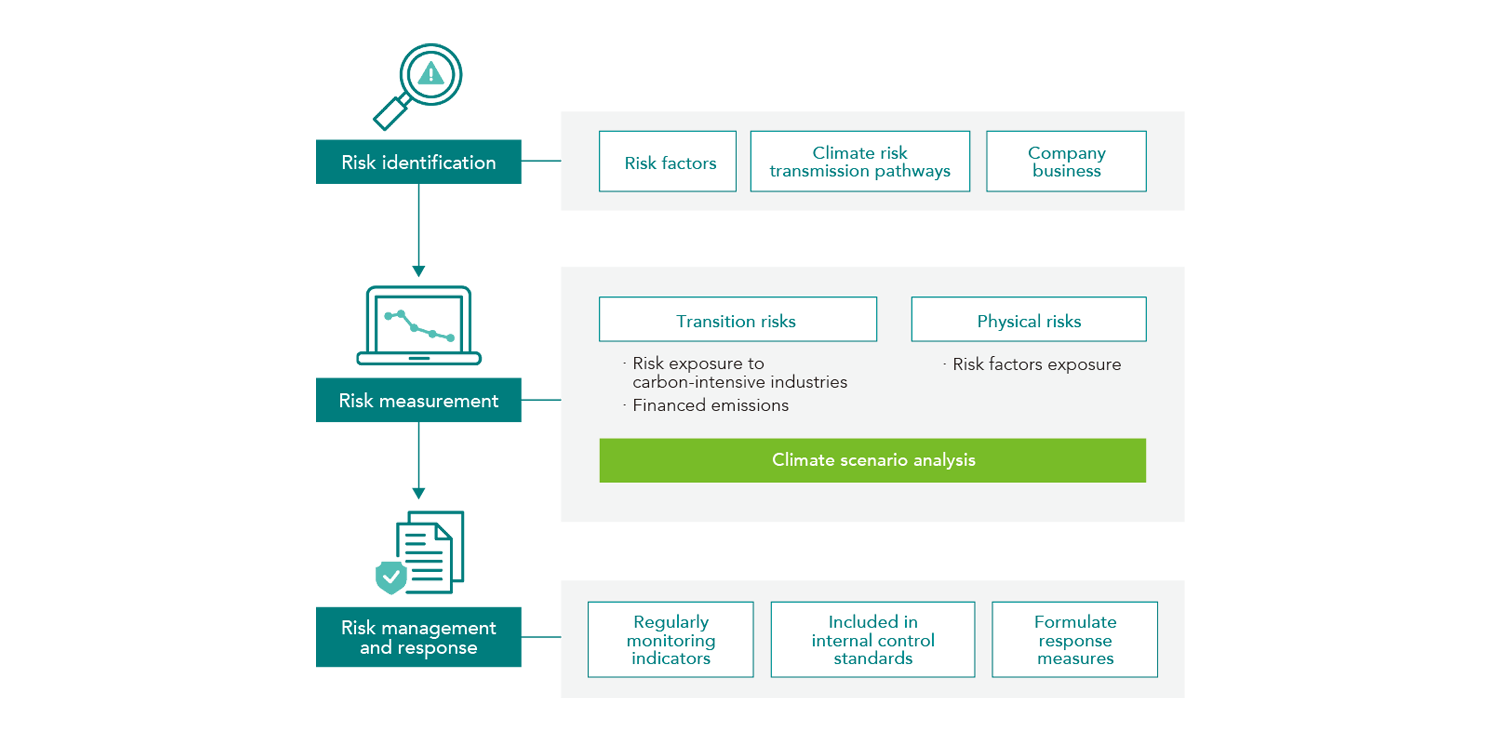

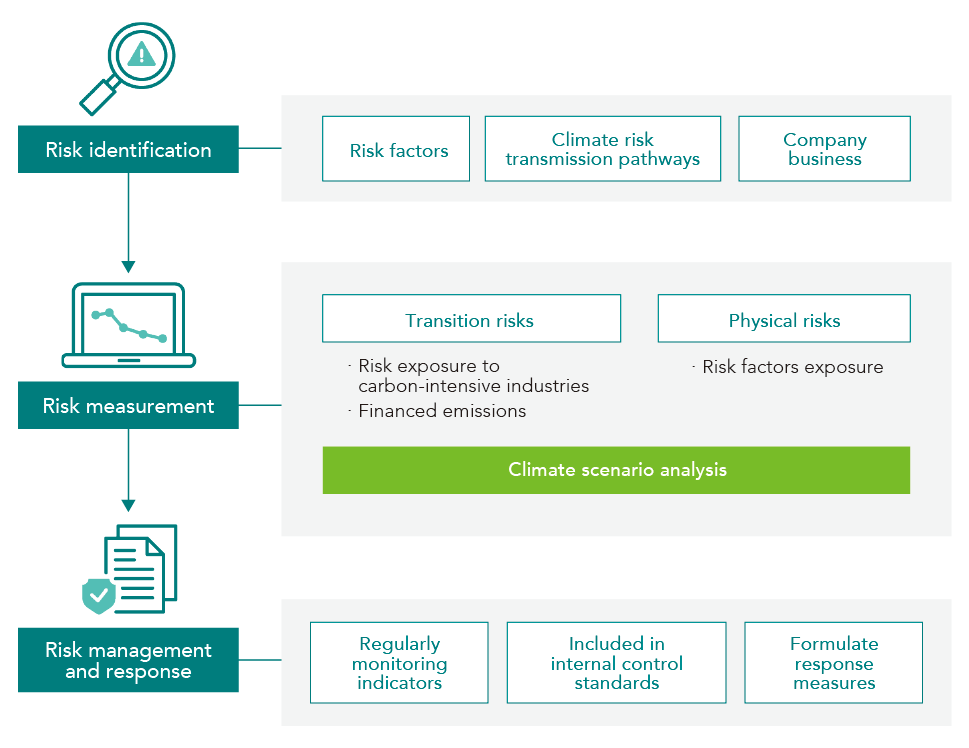

● Risk Management Procedures

Climate Metrics and Targets

In compliance with CTBC Holding’s SBTi-based goals for business operation (Scope 1 and 2) emissions, we have formulated an annual reduction target of 4.5% by 2035, with 2021 as the baseline year.

For the Scope 3 investments in listed companies, target management is conducted using the temperature rating method, and 2027 is set as the target year with a target temperature rise of 2.47°C. The Company's temperature performance in investments as of December 2024 was 2.13°C. This is in line with the carbon reduction pathway, and we will continue to maintain this positive performance as well as to promote low-carbon business operations and the low-carbon transition through practical actions in order to achieve the 2050 net-zero goal.