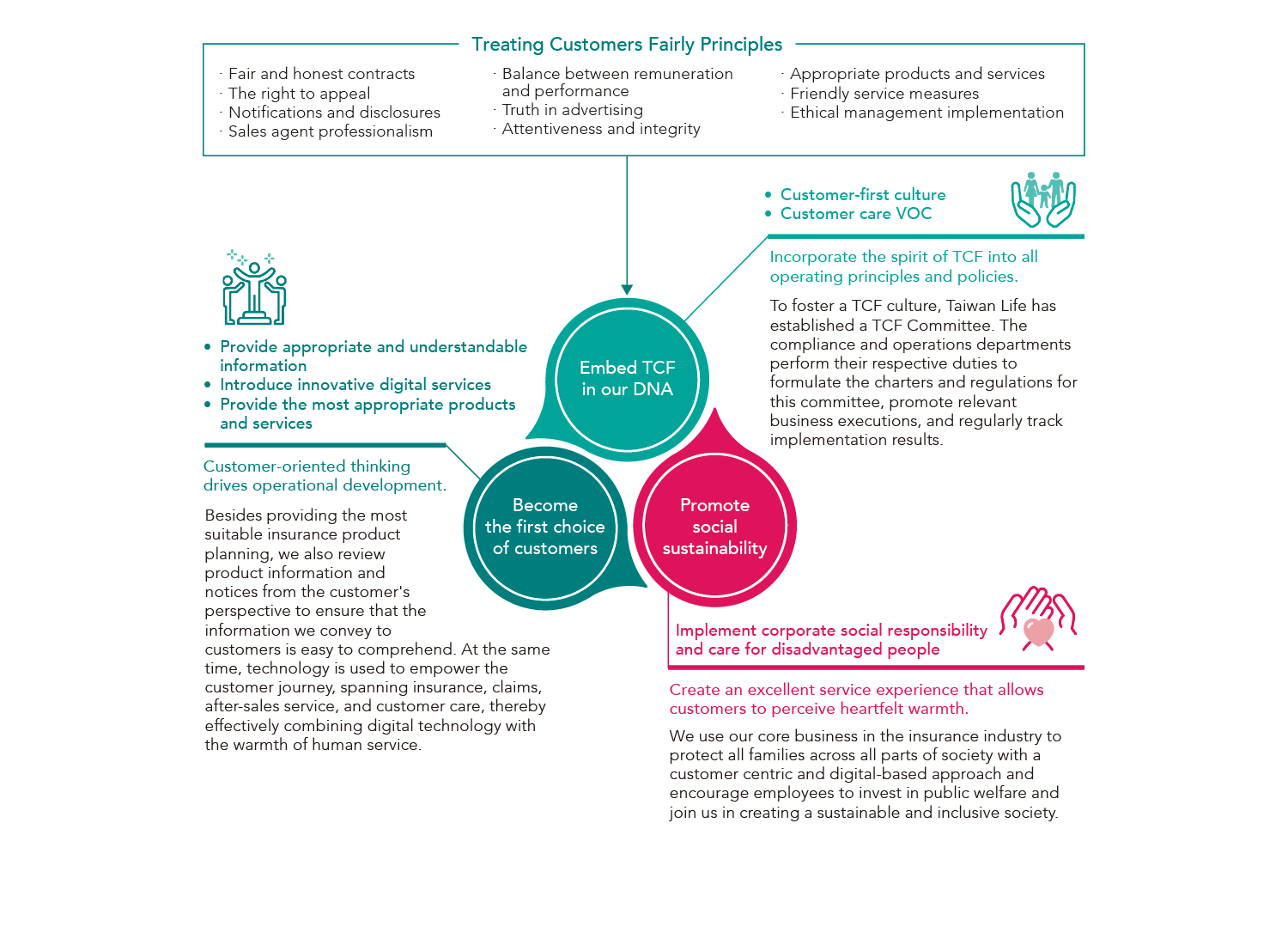

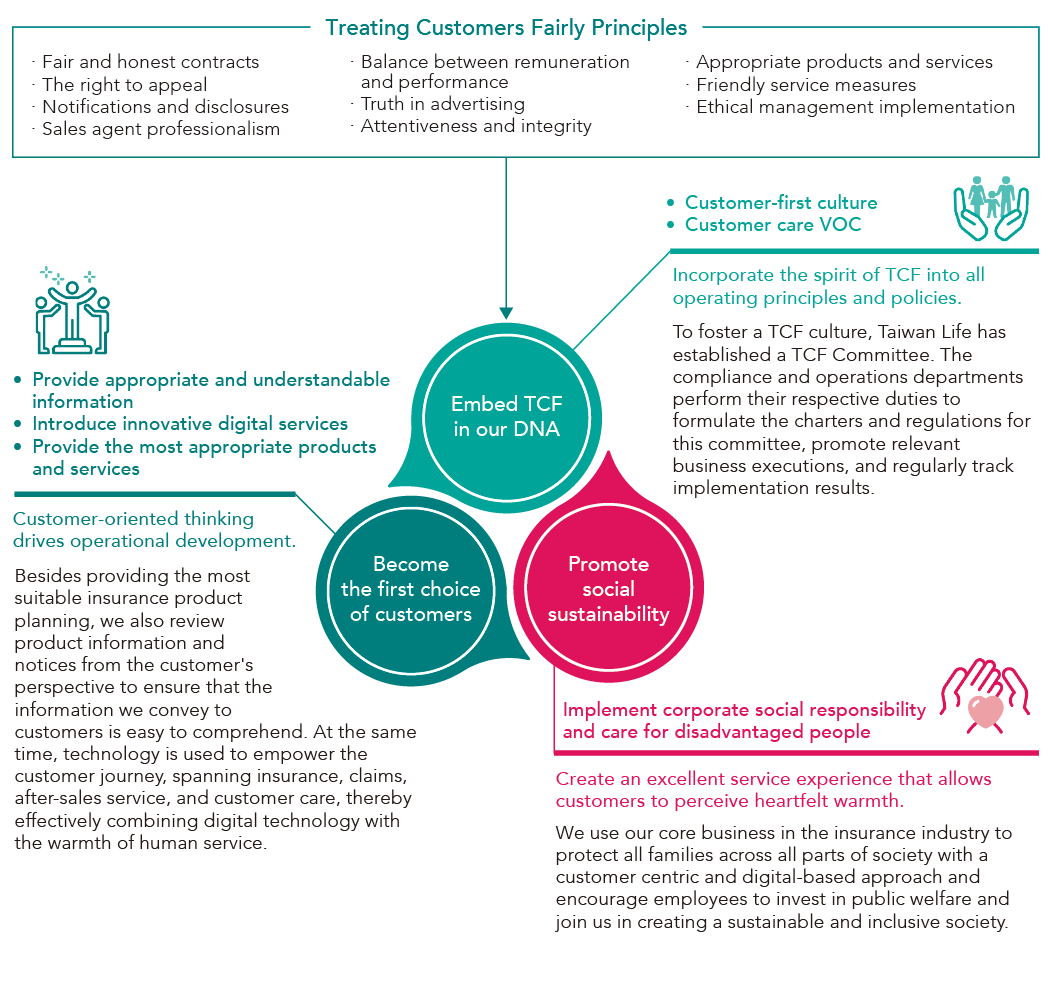

In 2024, Taiwan Life continued to comprehensively improve its Treating Customers Fairly (TCF) practices through three major policy pillars: "Embed TCF in our DNA,” "Become the first choice in customer referrals,” and "Promote social sustainability." The Company's Operation Planning Department is the dedicated unit responsible for TCF and financial friendliness; it coordinates, plans, and promotes the implementation of TCF across relevant units. The head of the Operation Planning Division is responsible for supervising the implementation of TCF and financial friendliness. The Board of Directors is the highest supervisory body for TCF-related efforts. The Board of Directors meets quarterly with senior executives to present TCF and execution plan results.

Taiwan Life's fair customer service has been recognized by the FSC, ranking in the top 25% in the 2024 Treating Customers Fairly Principles evaluation among life insurance companies, and was also awarded the Best Improvement Award.

TCF Policy and Pillars

Promoting Diverse Anti-Fraud Measures to Protect Public Assets

To combat fraud and actively support the anti-fraud strategy of the Life Insurance Association, the Company's Chief Compliance Officer serves as the convener of the Anti-Fraud Project Task Force of the Life Insurance Association of the Republic of China. The Company has established internal anti-fraud management mechanisms and conducts audits and reviews of their effectiveness. In 2024, we prevented customers from losing approximately NT$5 million to fraud.● Fraud Prevention Management Mechanisms

- First line of defense: Identification and prevention:

Sales agents and counter service personnel raise their alertness if they notice customers urgently wanting to terminate a contract or borrow money, or if they mention keywords such as "investment," "LINE group," or "guaranteed profit." They will engage in casual conversation to understand the customer's motivation. If a potential scam is identified, they will advise the customer and, if necessary, notify the police to assist in persuading the customer to avoid the scam. Additionally, in 2024, we introduced the "Commercial Short Code" 68688 service, which helps customers quickly identify the source of calls and reduces the risk of impersonation by fraudsters. - Second line of defense:

Documentation for further protectionIn addition to advising, counter service personnel will follow the anti-fraud SOP to note the case in the system and horizontally link the information to prevent the customer from proceeding through other channels. Multiple layers of protection are implemented to prevent fraud. For policy surrender or policy loan telephone confirmations, beyond verifying customers' understanding of their application, we remind the customers to stay calm and carefully verify any suspicious messages or calls to avoid being scammed. - Third line of defense:

Care callsSpecial anti-fraud protection and care measures are provided for older customers, such as when older policyholders requesting policy loans and surrenders, with dedicated personnel making prepayment telephone calls to provide fraud prevention reminders.