As part of our efforts to promote sustainable finance, we voluntarily adhere to the PRI and have established a sound system of responsible investment. By doing so, we hope to support invested and financing parties on ESG-related issues while reducing our own investment risks in the process. Taiwan Life is responsible for leading the cross-subsidiary responsible investment project team under CTBC Holding’s ESG Taskforce. Following the sustainable finance policy of the parent company, Taiwan Life formulates responsible investment guidelines and sets goals accordingly. In the quarterly ESG Taskforce meeting, Taiwan Life discusses related issues and presents the progress and results, which are consolidated by CTBC Holding’s Corporate Sustainability Department and reported to its Corporate Sustainability Committee. Guided by its comprehensive responsible investment strategy and workflow, Taiwan Life is working to realize its commitment to the interests of clients, shareholders, and society; fulfill its responsibilities as an institutional investor; and promote responsible investment and financing.

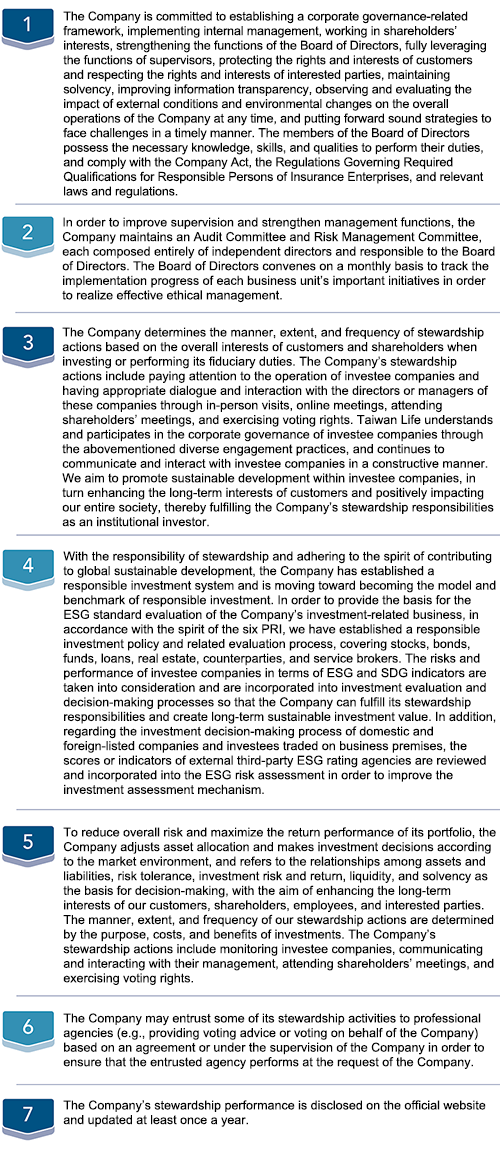

Stewardship Policy

Stewardship Policy

We uphold our commitment to customers and take the interests of shareholders as our top priority. In order to avoid conflicts of interest, we enforce regulations for managing such conflicts, conduct awareness raising, and have in place hierarchical responsibility, information control, firewall, and oversight mechanisms. These measures are taken to effectively control and prevent conflicts of interest. In 2024, Taiwan Life recorded no material conflicts of interest.

Voting Policy and Ownership

In order to fulfill our stewardship responsibility as an institutional investor, Taiwan Life has formulated and follows operating procedures regarding the exercise of its voting rights. As a matter of principle, to protect the rights and interests of customers and maximize the interests of shareholders, we actively attend the shareholders’ meetings of invested companies. Before each meeting, we carefully evaluate the motions on the agenda and related discussions. If necessary, we inquire and communicate with the management before a meeting to gain further understanding of each motion.

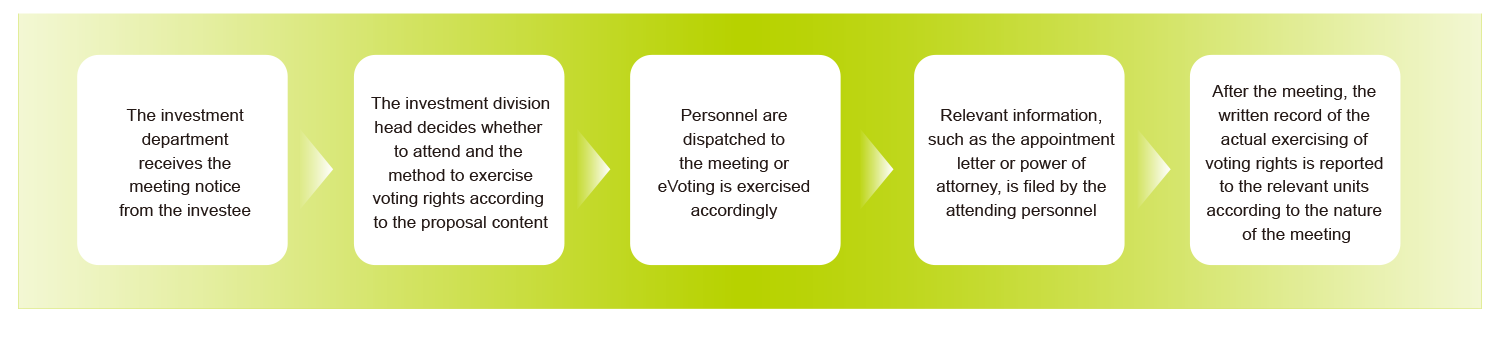

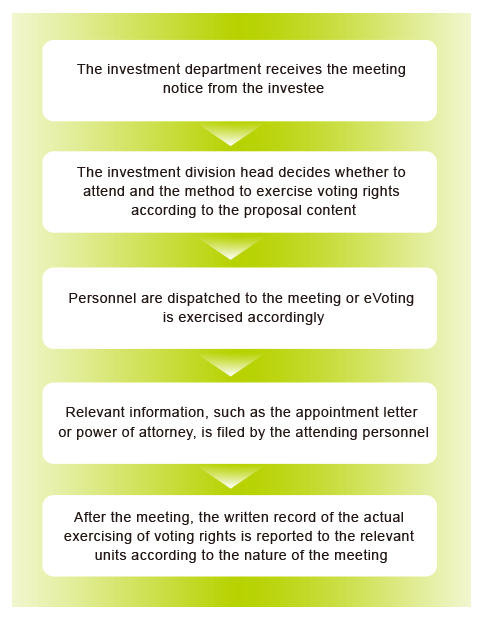

In addition to attending meetings in person to cast votes, we also exercise voting rights through eVoting. In principle, the Company exercises its voting rights in order to express its opinions on a motion. To this end, Taiwan Life may evaluate whether a motion will impair the rights and interests of the proposer, insured, beneficiaries, or shareholders, but ultimately whether to support a motion is at its discretion. Major operation procedures are as follows:

- In order to protect the rights and interests of customers, promote the overall interests of shareholders, and guide the Company’s investment department personnel in attending shareholders’ meetings and related meetings, Taiwan Life has formulated the Operation Guidelines for Attending Shareholders’ Meetings and Related Meetings of Investee Companies to facilitate the management of investee companies and promote their development.

- When receiving the relevant information on the notice of shareholders’ meeting, it is necessary to carefully evaluate whether the motions of each shareholders’ meeting and related meetings have a significant impact on the rights and interests of the Company’s customers or shareholders, and whether there are major issues; the business unit shall evaluate and retain related documents. If necessary due to the significance of the abovementioned impact, Taiwan Life will communicate with the management of the investee company before the meeting, and explain its evaluation and analysis of the exercise of voting rights. If it is a general meeting of shareholders and Taiwan Life can exercise its voting rights by eVoting, failure to attend meetings should be approved by supervisor.

- Taiwan Life may not exercise voting rights during election of directors or supervisors of an investee unless the investee meets any one of the following conditions:

① Meets the criteria for insurer’s funds in public utilities and social welfare

② Is traded on a foreign exchange or over-the-counter (OTC) market - When exercising the rights and interests of shareholders or investors due to the possession of marketable securities, Taiwan Life shall not exchange equity or transfer interests or participate in running the investee company by means of trust, appointment, or other contractual agreement or agreement, authorization, or other method with the investee company or a third party. The exercise of Taiwan Life’s rights and interests as a shareholder or investor shall not prejudice the interests of the proposer, the insured, or the beneficiary.

- Taiwan Life and its affiliated companies shall not act as the solicitor of power of attorney of the investee company or entrust others to be the solicitor of power of attorney or jointly solicit power of attorney with others.

- The voting rights of Taiwan Life include expressing support, objection, or abstention, but not absolute support for the content of the motions proposed by the investee company. On the basis of respecting the business expertise of the investee company and promoting its effective development, we support proposals put forward by the management in principle. However, proposals that impede the sustainable development of the investee company or violate the Company’s Responsible Investment Policy will not be supported in principle.

● Flow chart of Taiwan Life’s attendance at investees’ shareholders’ meetings and related meetings